Past Performance

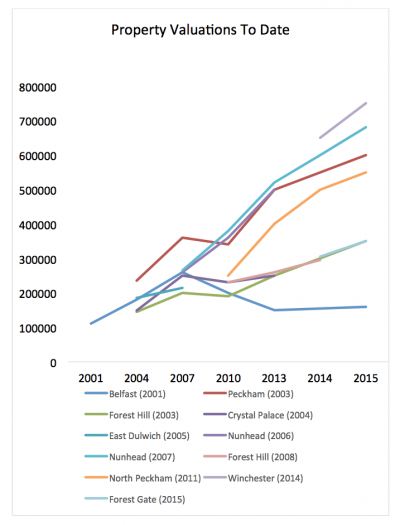

Colin began developing property in 2001 when he bought his first buy-to-let investment in Belfast. Further projects followed in south east and east London between 2003 and 2010. The main strategy at that point was to develop flats and houses around the London Overground rail line which was due to be opened in 2010. Property valuations increased significantly during this period. See graph below for more information.

The main strategy between 2010 and 2015 was to target the purchase of affordable three bedroom properties in London with new potential for capital appreciation and high rental yields. These properties were within easy reach of the City of London, Canary Wharf and the West End with access to good schools and vibrant local communities and which benefit from new transport links, such as Crossrail, which will be introduced in 2018. See graph for more information on the capital appreciation on these properties.

Since 2015, investors purchased properties for a total of just under £1,000,000. Investors spent £200,000 on building & renovation and as a result, these properties have been valued at a total of just under £1.5 million, with capital appreciation during that period of £300,000. The total annual rental return (rent) on these properties is £53,280 before tax. Annual interest-only mortgage payments are £15,898. So, there is currently an annual surplus or passive income of £37,382.